The Coin Values Blog

Stay up to date with in-depth analysis of the coin collecting, investing, and numismatics world.

On April 2nd, 2025, President Trump blindsided US markets and the entire world with his "Liberation Day" reciprocal tariffs. Without getting into the details or politics of that day's announcements, what is clear to be seen is that one thing that has surely been liberated is the gold price....

Understand that what we are all living through today is the result of cumulative mismanagement (economically, financially, politically and now, even socially) which began in 1913. We are living through a phenomenon foretold decades ago by The Austrian School of Economic Thought they named, Crack Up...

Quoting Gordon Gekko from the 1987 movie Wall Street: "I don't throw darts at a board. I bet on sure things. Read Sun-tzu, The Art of War. Every battle is won before it is ever fought." Mr. Gekko is explaining that an investment decision should start with research. ...

With most of the world on lockdown, financial markets crashing, the economy imploding and serious social consequences on the horizon, it is no surprise that the unprecedented crisis unleashed by COVID-19 is having serious effects on precious metals. While gold and silver futures ride their roller coaster in the...

The American Innovation $1 coins are among the latest releases from the United States Mint, and the first of these new golden dollar coins honors an astronomical pioneer from the state of Delaware. The name of this "star" is Annie Jump Cannon, and she was instrumental in developing the...

Many coin collecting websites share tips on how to build a set of Lincoln cents, 50 State Quarters, or even silver dollars. But what about half dollars? This oft-overlooked denomination offers hobbyists a whole world of exciting collecting challenges. What are some of the ways you can build a...

The new American Eagle 2019 One Ounce Palladium Reverse Proof Coin is the latest installment in the long-running American Eagle bullion coin family, born in 1986 with the release of the first American Gold Eagles and American Silver Eagles. The 2019 reverse proof palladium eagle also becomes the third...

Have you heard about the 2019-W America The Beautiful (ATB) Quarters? These new coins from the West Point facility of the United States Mint total just 10 million in number and have entered mainstream circulation. That means they can turn up just about anywhere – pocket change, coin rolls,...

In coin collecting, almost everyone knows about the famous rarities… The 1913 Liberty nickel, 1894-S Barber dime, and – of course – the 1804 Draped Bust dollar. But what many numismatists don't hear about, or in some cases even know about, are the silent rare coins. These pieces are...

Want to buy coins but aren't sure which ones to go after? While there's no guarantee that anything you buy will go up in value, there are many coins that have performed quite well over the years and, if they keep up with long-term trends, are...

Having a hard time finding Canadian pennies in circulation these days? It's not just you! That's because the last Canadian one-cent coins were made for circulation in 2012. And as they're being spent and turned in at banks, they're winding up at the smelter and disappearing forever. ...

I've been looking for rare and valuable coins in my pocket change since 1992. Over the years, I have come across many cool coins in circulation, including old Lincoln wheat cents, Liberty and Buffalo nickels, wartime silver Jefferson five-cent pieces, silver dimes and quarters, 90% silver Kennedy half dollars,...

The United States Mint has made history by striking the first Lincoln cents bearing the "W" mintmark from the West Point Mint in New York, and collectors are loving these new pennies. There are three types of 2019-W pennies being struck, and each is being offered as a premium...

The 2019 W quarters from the West Point Mint in New York are in circulation and collectors are going crazy trying to find these rare and valuable coins in their pocket change. But why are these new quarters being made at the West Point Mint? Why are they valuable?...

As a 30-something coin collector, I'm not necessarily representative of the median age of coin collectors and coin investors. In fact, I'm probably a good 20 years younger than most of the people I see enjoying the coin shows I attend. But I'm by no means the youngest guy...

I recently celebrated my 25th coin collecting anniversary – I'm now in my second quarter century as a coin collector, and so far I'm loving the hobby more than ever. I didn't know in 1992, when I first began collecting coins, that I'd still be enjoying this hobby so...

Are you looking for new coins to add to your coin collection? There are various avenues coin collectors use for finding new coins to add to their collections, and below I'll describe the various common methods you can use to find new coins for your collection.

There's a very special reason large cents from 1793 are spending more time in the numismatic spotlight recently. They represent the very first official coinage of the United States Mint, which was established in Philadelphia in 1792 and began striking federal coinage in 1793. The United States Mint first...

Morgan dollars are among the most popular United States coins around, and they are found in the collections of countless collectors new and seasoned alike. Most Morgan dollars are relatively common and circulated examples are often worth little more than their intrinsic silver content value. However, there are several...

It's a new year, and that means new coins are on their way for collectors in 2018. There's a bevy of new coins in 2018 from the United States Mint, including longtime favorites such as Lincoln cents, America the Beautiful quarters, American Eagle bullion coins, and much more. But...

British pennies are some of the most widely collected copper coins in the world, and they even have a place in the hearts of many coin collectors in the United States, whose residents use the one-cent coin – which is mistakenly referred to as a "penny." ...

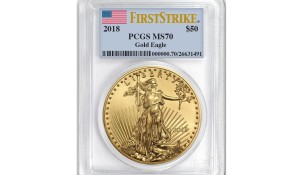

Have you seen the advertisements offering new 2018 American Gold Eagle coins? They're already popping up, and it begs the question: is now a good time to buy gold coins? Should you buy 2018 American Gold Eagles?

Commitment of Traders Report (the COT Report) on gold and silver futures trading is a weekly report released on a Friday for data at end of trading day the previous Tuesday by cftc.gov for trading positions, long & short, at COMEX (a subsidiary of CME Group).

Is it wise to buy junk silver coins when silver bullion prices tumble? Many bullion investors want know, especially when the metals market behaves as it has recently. Silver prices go up, then they go down. When silver prices go down, bullion investors do one of two things: ...

For many coin collectors, Eisenhower dollars are a coin from "just yesterday." Yet, as of 2018, the last Eisenhower dollar will have rolled off the presses 40 years earlier, in 1978. The first issues of the Eisenhower dollar series were struck in 1971 – nearly 50 years ago. Perhaps...

{{#ratings}}

{{title}}

{{#ownerCreatedBlock}}

{{/ownerCreatedBlock}}

{{#category}}

{{#editor}}

({{count}})

{{/editor}}

{{#user}}

({{count}})

{{/user}}

{{/ratings}}

-

{{#owner}}

-

{{#url}}

{{#avatarSrc}}

{{name}} {{/url}} {{^url}} {{#avatar}} {{& avatar}} {{/avatar}} {{name}} {{/url}} - {{/owner}} {{#created}}

- {{created}} {{/created}}

Category: {{category.title}}

{{/category}}

{{#fields}}

{{#showLabel}}

{{/fields}}

{{label}}:

{{/showLabel}}

{{& text}}